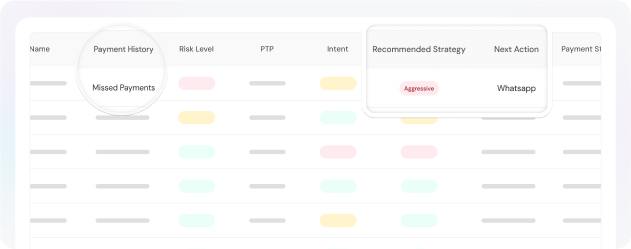

Enterprise Complexity? No Problem.

Fundamento is purpose-built to meet the demands of enterprise-scale operations, ensuring seamless borrower interactions while maintaining security, compliance, and scalability. With flexible deployment options—private cloud, hybrid, or on-premises—you retain full control over your data while ensuring strict regulatory compliance. Our platform integrates effortlessly into complex lending ecosystems, powering efficient, compliant, and scalable customer engagement.